Preinstructional Planning

Objectives

Students will:

- Understand how taxes and other deductions account for the difference between gross and net pay

- Understand the difference between voluntary and involuntary deductions

- Calculate the dollar amount of deductions by applying the relevant percentage to gross pay

Materials

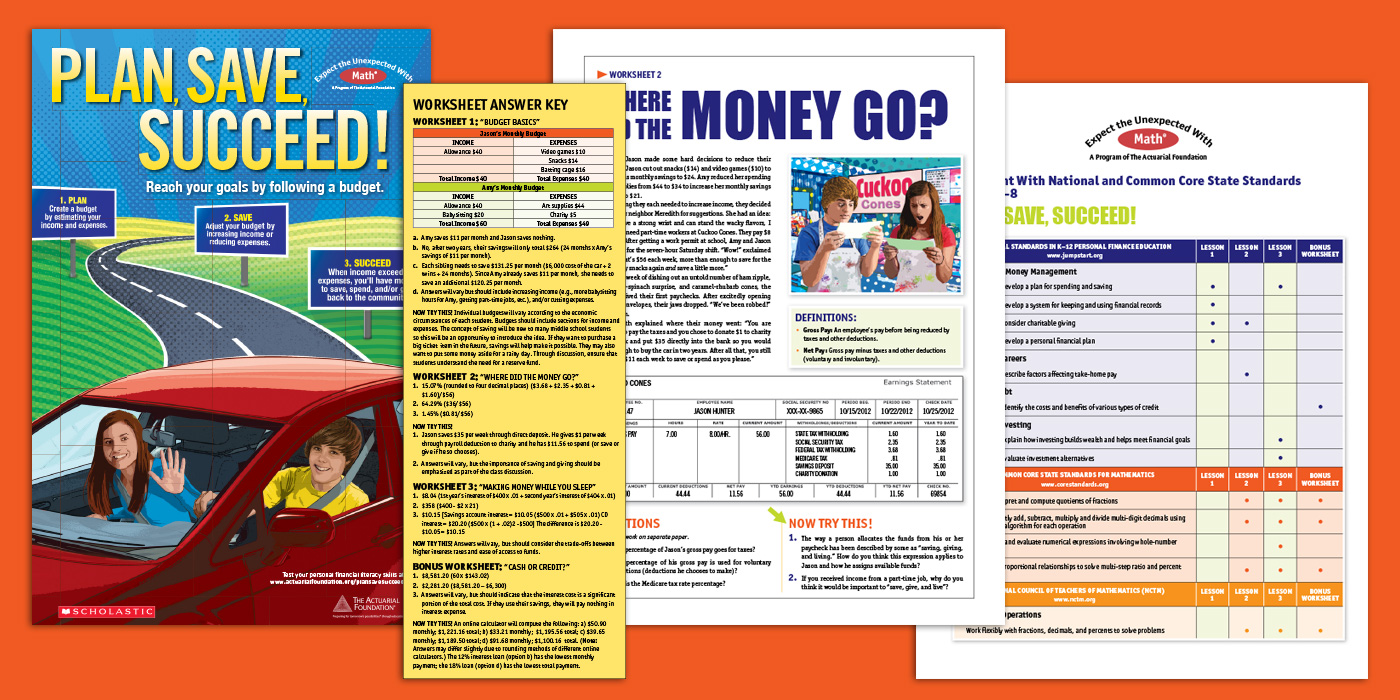

- Plan, Save, Succeed! Worksheet: Where Did the Money Go? printable

- Answer Key: Plan, Save, Succeed! Worksheets printable

- Plan, Save, Succeed! Classroom Poster printable

- Standards Chart: Plan, Save, Succeed! printable

- Optional: Bonus Worksheet: Cash or Credit? printable

During Instruction

Set Up

1. Make a class set of Plan, Save, Succeed! Worksheet: Where Did the Money Go? printable.

2. Print a copy of the Answer Key: Plan, Save, Succeed! Worksheets printable.Lesson Directions

3. Hang a copy of the Plan, Save, Succeed! Classroom Poster printable in your classroom where students can see it.

Lesson Directions

Step 1: Ask students where they've heard of taxes in real-life situations. Possible responses include sales, income (federal and state), and property taxes. Since most students are familiar with sales tax, mention that sales tax is added to the cost of an item to arrive at the final cost of a purchase.

Step 2: Demonstrate how percentages are applied when calculating sales tax. Use the example of a $740 laptop computer in a state with 5% sales tax. First, show how 5% is converted to the decimal .05 and multiplied by $740 to arrive at a sales tax of $37. Adding the price of the laptop ($740) and the sales tax ($37) results in the total cost of $777.

Step 3: While sales tax is added to the starting amount of a purchase price, some taxes represent deductions from an amount a person earns. For example, in the case of Social Security, wages are taxed at 4.2% (through year 2012). So a person making $1,200 per week will have $50.40 (.042 x $1,200) deducted from his or her weekly gross pay.

Step 4: Distribute the Plan, Save, Succeed! Worksheet: Where Did the Money Go? printable to students.

Step 5: After students have completed the questions, use your copy of the Answer Key: Plan, Save, Succeed! Worksheets printable to review answers with the class. As you review the answers, make sure that students understand the difference between voluntary deductions like charity and savings, and involuntary deductions like taxes. To make it easier for employees to save, buy insurance, invest in retirement plans, and/or give to others, many employers offer to automatically deduct money from an employee's gross pay and deposit it directly into the employee's bank account or send it directly to charities.

If time allows, explain what Social Security and Medicare are. Also explain that some states and municipalities require other involuntary deductions like city tax, contributions to state disability or unemployment funds, etc.

Lesson Extensions

For additional practice, have students complete the Bonus Plan, Save, Succeed! Worksheet: Cash or Credit? printable.